TruStage™ Zone Income Annuity

Help clients turn market opportunity into lifetime security with TruStage™ Zone Income Annuity from MEMBERS Life Insurance Company. Built-in downside protection means your clients benefit from indexed upside potential without the worry of wild market swings risking the stability of their nest eggs.

Product overview

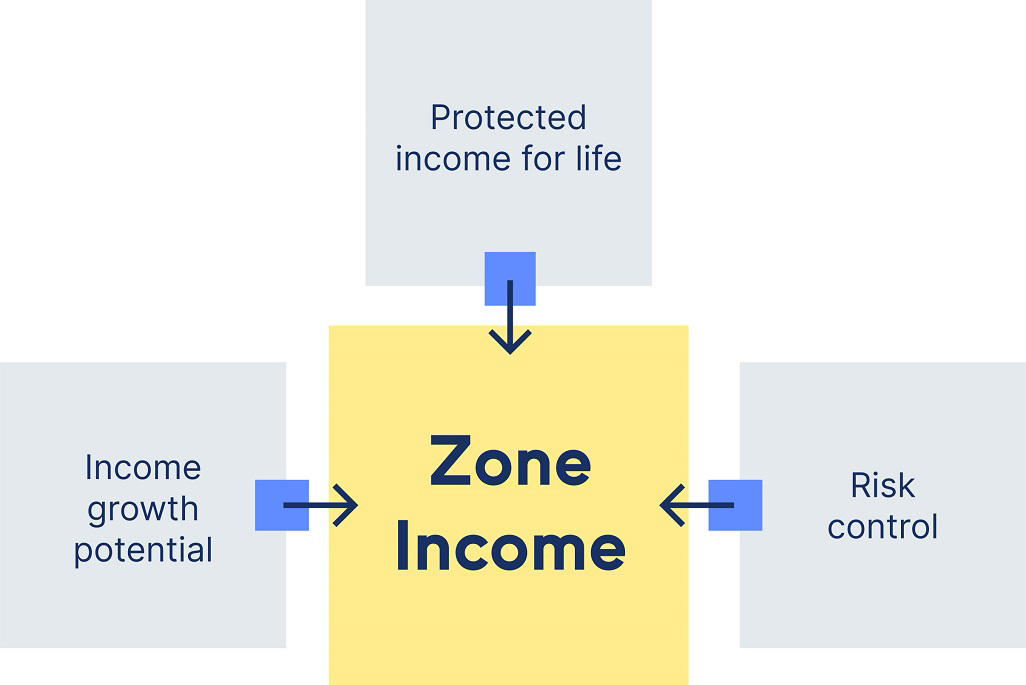

By blending growth potential and risk control, this registered index-linked annuity (RILA) turns unpredictable markets into steady momentum.

Help clients build lifetime income on their terms

- Configurable floors and caps empower your clients to set boundaries based on their personal risk tolerance.

- They adjust a custom "comfort zone" or their withdrawal payment.

- Clients choose to allocate purchase payments into four market index options or a declared rate account.

- They're in the driver's seat with options to change allocation options and risk control accounts each year.

- They enjoy a Guaranteed Lifetime Withdrawal Benefit, or protected income for life, which has the potential to grow along with their benefit base.

Crunch the numbers

Help clients envision the possibilities with this annuity calculator.

Key benefits for your clients

Zone Income Annuity offers index-linked returns, a limit on potential losses and lifetime income options.

Adapts to life's surprises

- Year by year, clients can change allocation options and risk controls to match new priorities.

- Built-in flexibility allows them to adjust their income payment as needed.

Growth plus protection

- Double-digit upside potential is well suited to growth-oriented investors.

- Clients define their downside limit up front by selecting floors from 0% to -10%.

Protected income for life

- Clients secure guaranteed lifetime income without sacrificing growth potential.

- Their payments will never decrease,¹ even after starting the income phase.

Zone Income Annuity resources

The best annuity is the one you design together. Use these tools to cocreate a personalized strategy.

Become an appointed advisor

Ready to offer TruStage annuity solutions? Hit the button below to get started.

Modern defense for market volatility

This innovative approach to market-linked risk control delivers protection that traditional investment diversification can't.

TruStage annuity families at a glance

Registered index-linked annuities

Registered index-linked annuities (RILAs) can offer clients market-linked growth potential balanced with a measure of downside protection.

Learn moreFixed annuities

You can offer a stable, tax-deferred way for risk-averse clients to grow their savings and guarantee income to help pay for retirement.

Learn moreIncome annuities

Clients nearing (or in) retirement may need help creating a strategy for a steady stream of income.

Learn more