- TruStage business resources

- Insights & trends

- Financial trends

- Making strategic choices for growth

Making strategic choices for growth

Download our latest whitepaper and discover strategies used by top-performing credit unions to accelerate loan growth, improve return on assets (ROA) and enhance member engagement.

This comprehensive research delves into the strategic choices of credit union performance leaders in loan growth, membership growth and ROA. Gain insights into their key similarities and differences to help inform your credit union’s future strategies.

Definition of growth leader

Credit unions in the top 1/3 tier of loan growth, membership growth or ROA performance as defined below.

Loan growth leader

2020-23 Compound annual growth rate (CAGR) greater or equal to 12.7%

Member growth leaders

2020-23 CAGR greater or equal to 3.3%

Return on assets leader

Q3 2023 ROA greater or equal to

92.5 basis points

Key strategic differences among growth leaders

All three types of leaders tend to prioritize agility and adaptability.

Digital adoption

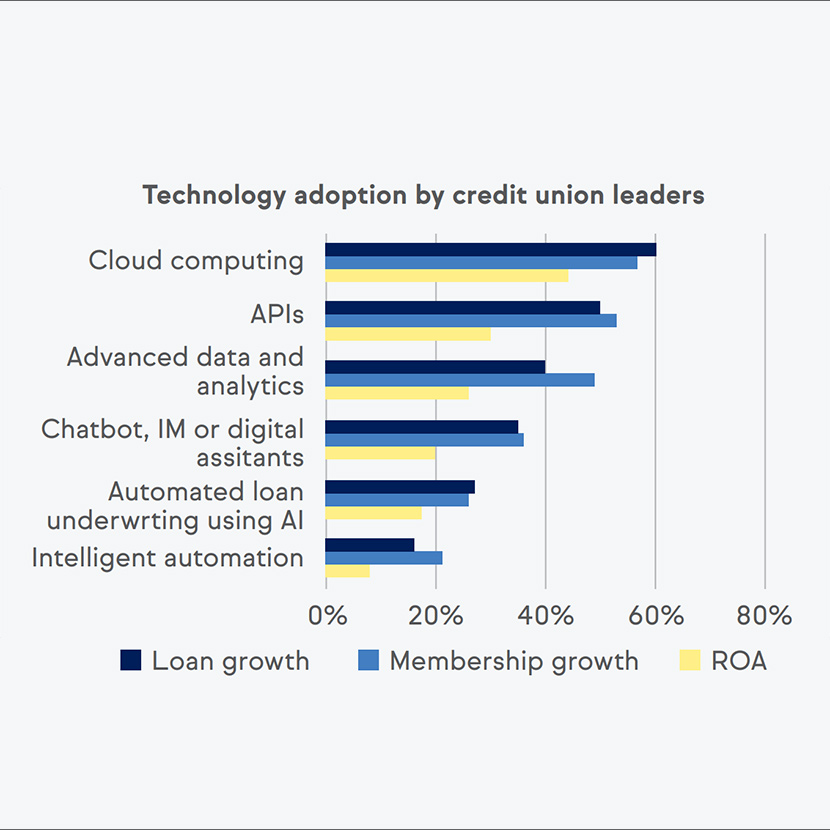

Loan and membership growth leaders are more likely to adopt advanced digital technologies compared to ROA leaders.

Strong community presence

Membership growth leaders are significantly more likely to cite strong community presence as a key competitive advantage compared to the bottom 1/3.

Importance of branches

Loan growth leaders are no more likely than those in the bottom 1/3 to consider branches a top distribution channel. By contrast, membership and ROA growth leaders are more likely to consider branches as a top distribution channel than the bottom 1/3.

All lending leader types tend to prioritize agility and adaptability

Having an agile and adaptable culture enables top-performing

credit unions to:

- Respond to change

- Better meet member needs

- Innovate

- Manage risk

- Retain satisfied employees

- Optimize processes

- Foster a culture of continuous improvement

About research and authors

Author: Steve Heusuk

Director of Competitive & Marketing Intelligence, TruStage™

Every year, TruStage partners with credit unions to explore market trends, uncovering valuable insights that shape our understanding of the marketplace. Making Strategic Choices for Growth research explores the strategic choices of credit unions in the top third for loan growth, membership growth, and ROA. It provides actionable insights for credit unions looking to enhance their strategies and drive growth.