- TruStage business resources

- Insights & trends

- Understanding customers

- Life insurance distribution case study

Case study: Life insurance distribution

Scaling the middle market profitably

Everyday Life is a fully licensed insurance brokerage on a mission to help everyone protect their loved ones. They believe life insurance is not a luxury, but a protective layer every family deserves.

The company set out to digitize and simplify online personalized insurance so consumers can find the right policy to fit their needs and budget. As Everyday Life embarked on this journey, it soon found itself with two main challenges that would test the company and its leadership.

Challenge 1: a gap in life insurance options

Everyday Life lacked good term life insurance options for middle market consumers and people over age 50. This gap led to a gap in product-market fit. “Those were lost sales, or consumers would buy something else, because they wouldn’t qualify for our flagship term product,” says Jake Tamarkin, CEO and co-founder of Everyday Life. “They’d end up buying an accidental death product, which is not what they wanted.”

Solution 1: filling a market gap

Partnering with TruStage™ has enabled Everyday Life to be successful with more consumer segments. Filling this gap not only helped Everyday Life increase average revenue per customer, but it also helped position the company within the industry as a one-stop shop for online life insurance coverage.

“People will say, ‘I didn’t think life insurance was in reach, and you made it attainable — fast, easy, affordable,’” says Jake. Everyday Life is committed to making the consumer journey as convenient as possible. The company advertises a 15-minute process to receive coverage. To do this successfully, Everyday Life needed to deliver a simplified consumer purchasing experience.

Interested in partnering with TruStage™ or have more questions?

Let's talk

Did you find this article helpful?

Download it hereLife insurance distribution case study with Everyday Life

Meet the CEO and co-founder |

Jake Tamarkin left behind an accomplished career on Wall Street in pursuit of a mission to eliminate the word “underserved” from the vocabulary of the insurance industry. Thus, Everyday Life was born. Jake is known for making financial services more useful and inclusive. |

Challenge 2: friction in the customer experience

The traditional way of selling life insurance is full of friction. “Every click kills conversions,” says Jake. “After a couple years in business, we learned that convenience is more important to our customers than rate.”

Everyday Life focuses on middle-income families and moms, particularly in their 30s and 40s. One thing all their customers have in common is that they’ve got a lot going on in their lives. “More than 80% of our sales happen on mobile phones outside of business hours,” says Jake. “As soon as there’s any friction, they’re onto the next thing.”

Solution 2: delivering an exceptional customer experience

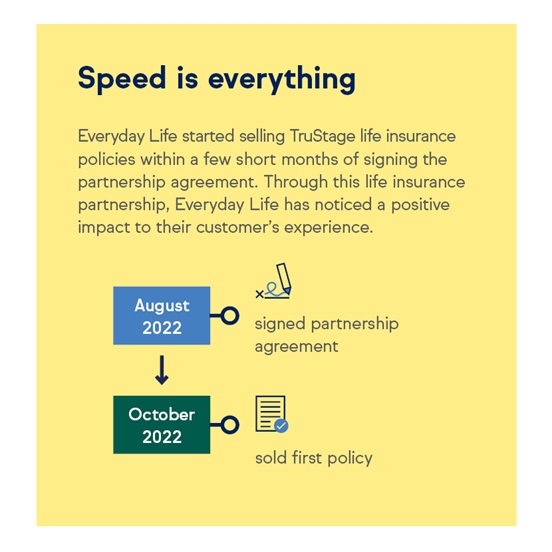

Partnering with TruStage helped Everyday Life meet — even exceed — their busy customers’ expectations.

“When we first started selling TruStage policies, we got a few phone calls from people in a state of disbelief: ‘I think I bought a quarter-million-dollar life insurance policy… but did it really take only 10 minutes? That was almost too easy,’” recalls Jake.

Jake adds that Everyday Life experienced a significant boost in positive Google reviews after partnering with TruStage. He attributes this uptick to the frictionless customer experience TruStage offers, including a very brief application, instant underwriting and typically no customer follow-up. “Most other partners that offer instant decision require follow-up,” says Jake.

In summary

Everyday Life entered the marketplace with a clear goal in mind, and a mission to help everyone protect their loved ones. The company has successfully differentiated itself from its competitors by focusing on two things: exceptional products and exceptional experiences. “You have to think about both to get it right,” Jake says. “TruStage obviously did.”